flow through entity taxation

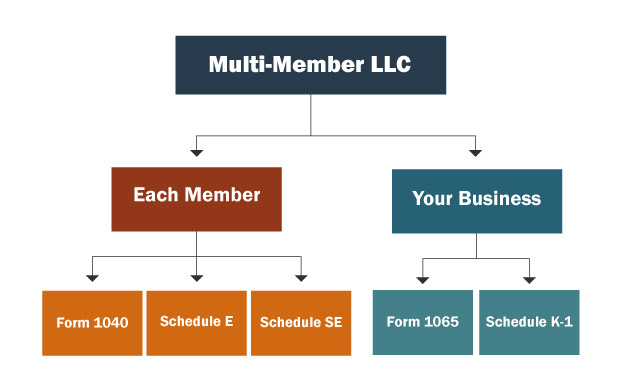

However if a qualifying LLC elected to be an S Corporation it should file a Form 1120S Form 1120S US. Income Tax Return and S corporation laws.

How To Choose Your Llc Tax Status Truic

A cash flow statement determines the inward outward flow of money in a business a bridge between the income statement balance sheet.

. Additional support during COVID-19. The S-Corporations profits still flow through to the owners aka shareholders. The New York State Department of Taxation the Tax Department finally released much needed guidance in the form of a Technical Services Bulletin Memorandum TSB-M-211C 1I TSBM covering many open.

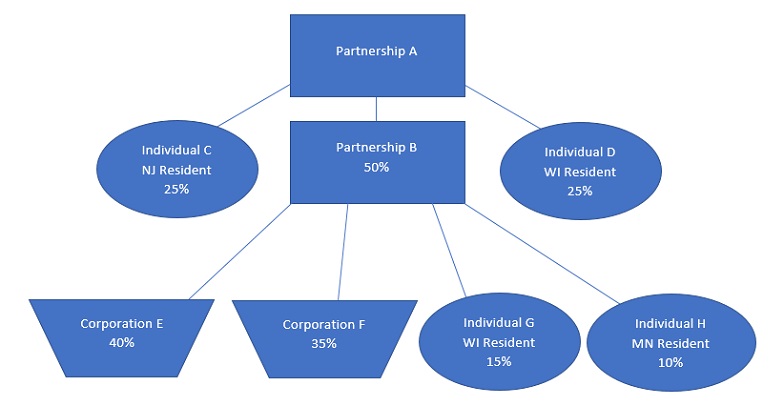

This means that the profits of the business are passed through to the owners called members. FFC handed down its decision in Federal Commissioner of Taxation v Apted 2021 FCAFC 45 for more information see. 313 FTEs are based on conduit theory or pipeline theory which is defined as a method of integrating the taxation at the entity and participator level under which income or deductions flow through from the entity to its participators.

Help for not-for-profits including JobKeeper and Boosting cash flow for employers. Support for tax professionals Find out about the range of practical support options we offer you and your clients. The pass-through entity tax PTET under new Tax Law Article 24A-1.

Shareholders then report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates. Income gain loss or deduction that flow through to adirect partner that is a partnership or an entity not subject to tax under Article 22 even if the income is ultimately taxable to a partner under Article 22 through tiered partnerships. Reasons to Consider Using a Pass-Through Entity.

They can be responsible for tax on certain built-in gains and passive income at the entity level however. Businesses that use another entity to manage payroll. The taxation classification of a cooperative business is separate from its incorporation status.

Keep in mind that an LLCs distribution of profits are subject to an employment tax whereas an S Corps dividends are. An LLC multi-member or single-member can elect to be taxed as an S-Corp which typically makes sense once the LLC earns 70000 to 100000 in net. Investment Tax Credit for Carbon Capture Utilization and Storage.

As a result of the Small Business Job Protection Act of 1996 ESOP trusts are IRC Section 401a exempt organizations permitted as S corporation shareholders. Pass-through entities or flow-through entities make up over 60 percent of all business entities in the United States. For that reason a LLC or corporation operating on a cooperative basis can be taxed under Sub Chapter T while an entity incorporated as a cooperative would not qualify if it did not distribute patronage based on use and follow the other principles.

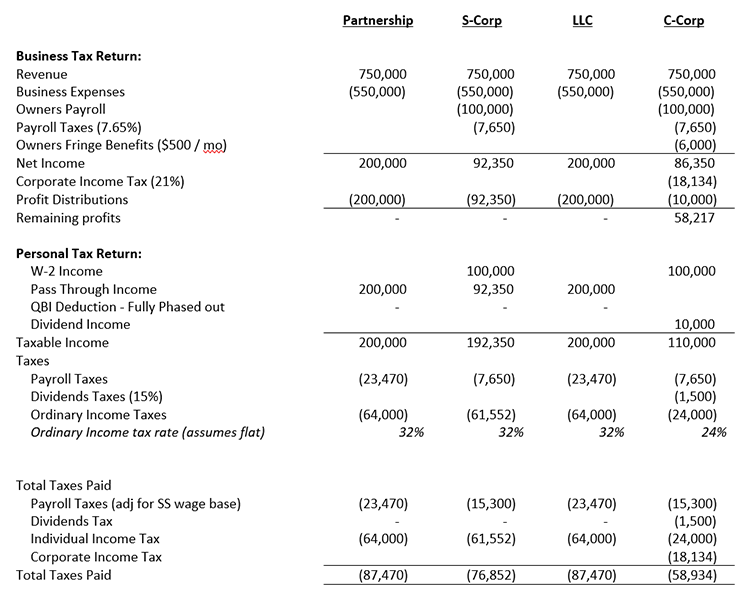

The 1120 is the C corporation income tax return and there are no flow-through items to a 1040 or 1040-SR from a C corporation return. A partnership may not be included in a consolidated return even if it is 100 owned by members of an affiliated group since a partnership is not a corporation. S corporations avoid double taxation on corporate income through this process.

C Corporations pay a flat 21 business income tax before income reaches shareholders. Whether or not an entity is Disregarded doesnt have anything to do with pass-through taxation though. The October 15 2021 deadline is quickly approaching for making the New York State Pass-Through Entity Tax PTET election for 2021.

As well as rules for allocating income or loss from a Flow-through Entity such as a partnership. A cash flow statement determines the inward outward flow of money in a business a bridge between the income statement balance sheet. In addition the PTET credit must be allocated to all eligible credit claimants according to the guidance in TSB-M-211C 1I Pass-Through.

Income Tax Return for an S Corporation Instructions US. We will provide tax-free cash flow boosts between 20000 to 100000 to eligible employers to support them during the economic downturn as a result of COVID-19. It is used to avoid double taxation when business income is subject to corporate tax.

For a taxation year that includes Budget Day the additional tax would be prorated based on the number of days in the taxation year after Budget Day. An eligible entity that opts in to PTET must include all partners members or shareholders resident and nonresident that are subject to tax under Article 22 when computing its PTE taxable income. An LLC is taxed as a pass-through entity by default.

Owners of C Corporations suffer from double taxation while pass-through entity owners are taxed just once. Business owners use pass-through entities to avoid double taxation on business assets income streams or transactions. Typically for example corporations pay income tax once.

A flow-through entity FTE is a legal entity where income flows through to investors or owners. Both an LLC and an S Corp has flow-through taxation no double taxation. Each year the shareholders receive an IRS Form K-1 and report the flow-through of the income on their personal tax returns based on their individual federal and state income tax rates.

However a members earnings that flow through from a partnership are included as part of the consolidated groups taxable income or loss. A pass-through entity also known as flow-through entity is a business structure in which business income is treated as personal income of the owners. Support for self-managed super funds Information on the support and relief available for SMSFs during COVID-19.

Pass Through Entity Tax 101 Baker Tilly

What Is Double Taxation For C Corps The Exciting Secrets Of Pass Through Entities Guidant

The Other 95 Taxes On Pass Through Businesses Econofact

Pass Through Entity Definition Examples Advantages Disadvantages

Elective Pass Through Entity Tax Wolters Kluwer

Pass Through Entity Tax 101 Baker Tilly

9 Facts About Pass Through Businesses

Dor Pass Through Entity Level Tax Partnership Determining Income And Computing Tax

Multi Member Llc Taxes Llc Partnership Taxes

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Choice Of Entity Choosing The Right Business Structure

Ab150 Creates Elective Pass Through Entity Tax

Pass Through Business Definition Taxedu Tax Foundation

Pass Through Entity Definition Examples Advantages Disadvantages

What Is A Pass Through Entity Definition Meaning Example

Flow Through Entity Overview Types Advantages

Pass Through Taxation What Small Business Owners Need To Know